HST Now Applies To All Assignments Of New Home / New Condominium Contracts (i.e. flipping)

The 2022 Federal Budget introduced two important changes governing the HST on the Assignment of a New Home and New Condominium Agreement of Purchase and Sale entered into with a builder (“New Home Contract”).

1) All Assignments Of New Home Contracts Are Now Subject To HST, Without Exception

This represents an important change, as in the past the question of whether the assignment of a New Home Contract attracted HST depended on the intention of the original buyer / assignor when the New Home Contract was signed. The result: some assignments were subject to HST, while others were HST-exempt.

With this change, all assignments of New Home Contracts are deemed to be a taxable supply subject to HST, regardless of the intention of the original buyer / assignor when the New Home Contract was signed.

This new provision of the Excise Tax Act (Section 192.1) applies to assignment agreements entered into on or after May 7, 2022.

2) Original Deposits May Be Exempt From HST Under Proper Conditions

For many years, it was unclear whether the original deposit paid in a New Home Contract was subject to HST when that contract is assigned (assuming the assignment itself was subject to HST). For example: assume the purchase price in a New Home Contract was $500,000. The deposits paid by the original buyer to the builder was $50,000. The original contract is assigned for an “assignment price” of $800,000. That price included the reimbursement of the original deposits ($50,000), and a “profit” of $300,000.

The federal government’s position, as stated in HST Info Sheet GI-120 is that the $50,000 deposits transferred to the assignee were subject to HST if the assignment was a taxable supply. However, according to a Tax Court of Canada case called Casa Blanca Homes, if the assignment was subject to HST, the $50,000 in transferred deposits would not have been subject to HST.

With the second change, HST will only be charged to the extent the assignment price exceeds the deposits paid by the original buyer / assignor to the builder in the New Home Contract. HST will not be charged on the original deposits paid ($50,000), provided the condition described below is met.

What does this mean for real estate lawyers acting for assignors and assignees?

a) An important condition must be satisfied to keep the original deposit HST-exempt. The Assignment Agreement must state, in writing, that part of the “assignment price” “is attributable to the reimbursement of a deposit paid under the purchase agreement” [i.e. the New Home Contract]. This means relief from exposing the transferred deposits to HST will not be automatic. The fact that the assignment price ($800,000) includes the transferred deposits ($50,000) must be clearly indicated in writing. Real estate lawyers acting for assignors must ensure that specific wording appears in the Assignment Agreement regarding the reimbursement of the original deposits, to ensure they remain HST-free.

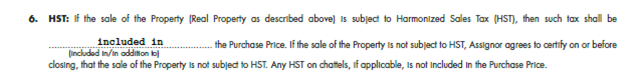

b) Extreme caution is needed when dealing with the HST clause in the OREA Assignment of Agreement of Purchase and Sale form (Forms 145 and 150). The clause states:

The wording is very similar to the HST clause appearing in the standard Agreement of Purchase and Sale (resale home and resale condo).

In resale residential transactions, the words “included in” are typically inserted above the line, as most of those transactions are HST-exempt.

With these changes to the HST, all Assignments of a New Home / New Condominium Agreement of Purchase and Sale with a builder will be subject to HST. Therefore, in Assignment Agreements:

i) assignors must not certify that the assignment is HST-exempt. (By doing so, assignors may be deemed to have collected 13/113 of the purchase price as HST under the Excise Tax Act.)

ii) assignees must be certain the words “included in” are inserted above the line, to ensure the assignor pays the HST on the assignment price (as typically is the case). If the words “in addition to” appear (making the assignment price exclusive of the HST payable), the assignee (and not the assignor) will be responsible for paying the HST on the assignment price which would be an unhappy surprise for the assignee.

This new provision of the Excise Tax Act also took effect on May 7, 2022.

The bottom line: as all assignments of new home contracts are now taxable, parties and their lawyers should carefully reconsider how prior practices on assignments, especially HST-included vs HST-extra, are negotiated.

By Simon Thang, Barrister and Solicitor; and Alan G. Silverstein, Barrister and Solicitor

Leave a Reply