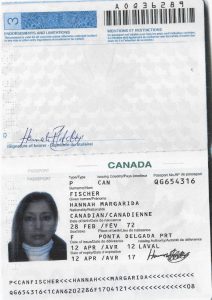

Business loan collection scam using the name Hannah Fischer

Date First Reported: June 2016

Primary Name Associated: Hannah Fischer

Description of Potential Fraud:

Two German firms notified us that they received an email from the purported Hannah Fischer looking to retain them with regards to a breach of a business loan agreement.

This is a classic bad cheque scam that presents as legal matter requiring the assistance of a lawyer. In this scam lawyers will be duped into wiring real funds from their trust accounts after depositing a fake cheque received as payment from the debtor (who is part of the fraud).

See our Confirmed Fraud Page for more of an explanation of how these frauds work and other names associated with it , and our Fraud Fact Sheet for a list the red flags of a bogus legal matter that is really a fraud.

Here is the initial contact email sent to the lawyer:

> Am 09.05.2016 um 07:25 schrieb Hannah Fischer [email protected]:

>

> Dear Counsel,

>

> This is an official request for your legal consultation services. My name is Hannah Fischer, and I am in needs of a legal representation from your law firm regarding a breach of Loan agreement I had with a friend of mine. He needed this loan to complete an ongoing project he was handling at the time in your jurisdiction. I need legal advice and assistance to know the best way to handle this issue. If this is your area of practice, please contact me to provide you with further Information.

>

> Regards,

>

> Hannah Fischer.

Replying to the email brought this response:

Good day to you and thanks for responding to my email.

My name is Hannah Fischer and my address is 1420 Rue Notre-Dame O, Montreal, Quebec, Canada. On December 4th, 2013, I lend Klaus Schneider whom now resides in your jurisdiction the sum of $620.000.00 with 8.5% interest on two years fixed term and to pay back December 4th, 2015. He had only paid me $140,000 but still owing $480,000.

He used to live here in Quebec before the loan was made, but has ever since relocated to your jurisdiction (München). I was advised to seek legal assistance in my borrower new jurisdiction which is why I contacted you to act as my counsel in retrieving these funds. There has not been any attorney working on this case. Different payment dates have been promised and I still have not received anything. My last contact with my borrower, I was told I would receive payment not later than Mid January 2016 and till now, nothing has been paid.

Kindly let me know what your fees would be in order for me to inform Mr. Schneider to expect contact from you, as you have been authorized to act on my behalf. On your approval, I would like to forward your details to him, so he knows a law firm is now involved, and that I could sue for breach of agreement if he does not oblige to the terms of the loan agreement. I would like to give him this last chance to fulfills his obligations before we start legal proceeding if need be.

Please do get back to me so I could furnish you with the required details to contact my borrower on my behalf. I know he respects the law, and wouldn’t want to be litigated. Before we proceeds, kindly forward your Fee / Client Engagement Agreement for my review, and if satisfied with terms and conditions upon receipt; I shall make immediate provision for the fee for you to begin work.

Thank you for your anticipated co-operation and understanding. Contact me should you require more information. I have attached here a copy of the Loan Agreement Promissory Note and proof of partial payment He made for your peruse. My borrower’s name is Klaus Schneider.

Regards,

Hannah Fischer.

How to Handle a Real or Suspected Fraud

If you have been targeted by any of these frauds, please forward any of the emails and supporting documents that you have received to [email protected]. We use this information for the warnings we post on AvoidAClaim. We do not disclose the names of firms that have provided us with information.

Ontario Lawyers - Call LAWPRO

If you are an Ontario lawyer acting on a matter that you suspect might be a fraud, call LAWPRO at 1-800-410-1013 (416-598-5899). One of our Fraud Team members will talk you through the common fraud scenarios we are seeing and help you spot red flags that may indicate you are being duped. This will help you ask appropriate questions of your client to determine if the matter is legitimate or not. If the matter you are acting on turns out to be a fraud, we will work with you to prevent the fraud and minimize potential claims costs.

What can you do to help put a stop to the fraud attempt?

You can simply stop replying to the fraudster’s emails or inform them that you suspect fraud and will not act on the matter. You can report the fraudsters’ email addresses to the email hosting company. If you have a fraudulent cheque you can destroy it or send it to the fraud department of the financial institution it is drawn upon. In Canada, you can report the fraud to the Canadian Anti-Fraud Centre.

We are often asked if it is worthwhile to report the fraud attempt to the police in the hopes of helping catch the fraudsters. You can certainly report the fraud to your local or federal law enforcement agencies, but unfortunately it is often difficult, expensive and time consuming for them to attempt to shut down these online fraud perpetrators (though there are some successes).

What if the fraud has been successful?

If you have been successfully duped, please immediately notify LAWPRO as there may be a claim against you. See the LAWPRO website for instructions on how to report a claim.

For more immediate updates on fraud and claims prevention, subscribe to the email or RSS feed updates from LAWPRO’s AvoidAClaim blog.

Fraud Fact Sheet

More fraud prevention information and resources are available on the practicePRO Fraud page, including the Fraud Fact Sheet, a handy reference for lawyers and law firm staff that describes the common frauds and the red flags that can help identify them. To proactively prevent trust account shortfalls and malpractice claims, LAWPRO encourages firms to teach their lawyers and staff about fraud and how to recognize fraud attempts.

Leave a Reply